Best Travel Expense Software: Features, Benefits, and Real-World Examples

Managing travel expenses manually can be overwhelming for businesses and frequent travelers. Travel expense software has become essential for streamlining reimbursement, improving budget control, and ensuring compliance with company policies. In this article, we explore the top informational keyword “best travel expense software” in detail, covering how it works, its benefits, real-world use cases, and leading software solutions available in 2025.

Understanding Travel Expense Software and Its Importance

Travel expense software refers to digital platforms designed to simplify the process of recording, reporting, and reimbursing business-related travel expenses. These platforms help employees track expenses in real-time, scan receipts, and submit claims directly through their mobile devices or desktops.

As businesses scale, managing receipts, mileage claims, airfare, and lodging expenses manually can lead to delays, errors, and potential fraud. With travel expense software, finance teams gain visibility into employee spending while automating key workflows such as policy enforcement and reporting.

How Travel Expense Software Works

Modern travel expense solutions offer integrations with corporate cards, real-time analytics dashboards, OCR (Optical Character Recognition) for scanning receipts, and mobile apps for on-the-go expense tracking. Here’s a high-level overview of how it works:

-

Capture Expenses: Employees take photos of receipts or import data from connected bank cards.

-

Automated Categorization: The software assigns each expense to predefined categories such as transportation, lodging, or meals.

-

Approval Workflow: Submitted reports are routed to managers for review and approval.

-

Reimbursement & Integration: Approved expenses are forwarded to payroll or finance systems for processing.

By automating these tasks, businesses can reduce the time and costs associated with manual expense reporting.

Key Benefits of Using Travel Expense Software

Improved Accuracy and Compliance

One of the most significant advantages of using travel expense software is the accuracy it brings. Manual entry often leads to errors, missed receipts, or non-compliance with policy guidelines. Automated systems ensure accurate categorization, reduce duplication, and flag policy violations before submission.

Time Savings and Faster Reimbursements

Traditional expense reports can take days or even weeks to process. With travel expense software, employees can submit expenses in real-time, and managers can approve them with just a few clicks. This means reimbursements are processed faster, improving employee satisfaction.

Centralized Expense Management

Having all travel-related expenses in one centralized dashboard gives finance teams better visibility into spending trends, helping them control budgets and plan more efficiently.

Seamless Integration with Accounting Tools

Most leading travel expense software integrates with popular accounting platforms like QuickBooks, Xero, or SAP. This integration ensures that approved expenses are synced directly to financial systems, reducing manual data entry.

Real-World Examples of the Best Travel Expense Software in 2025

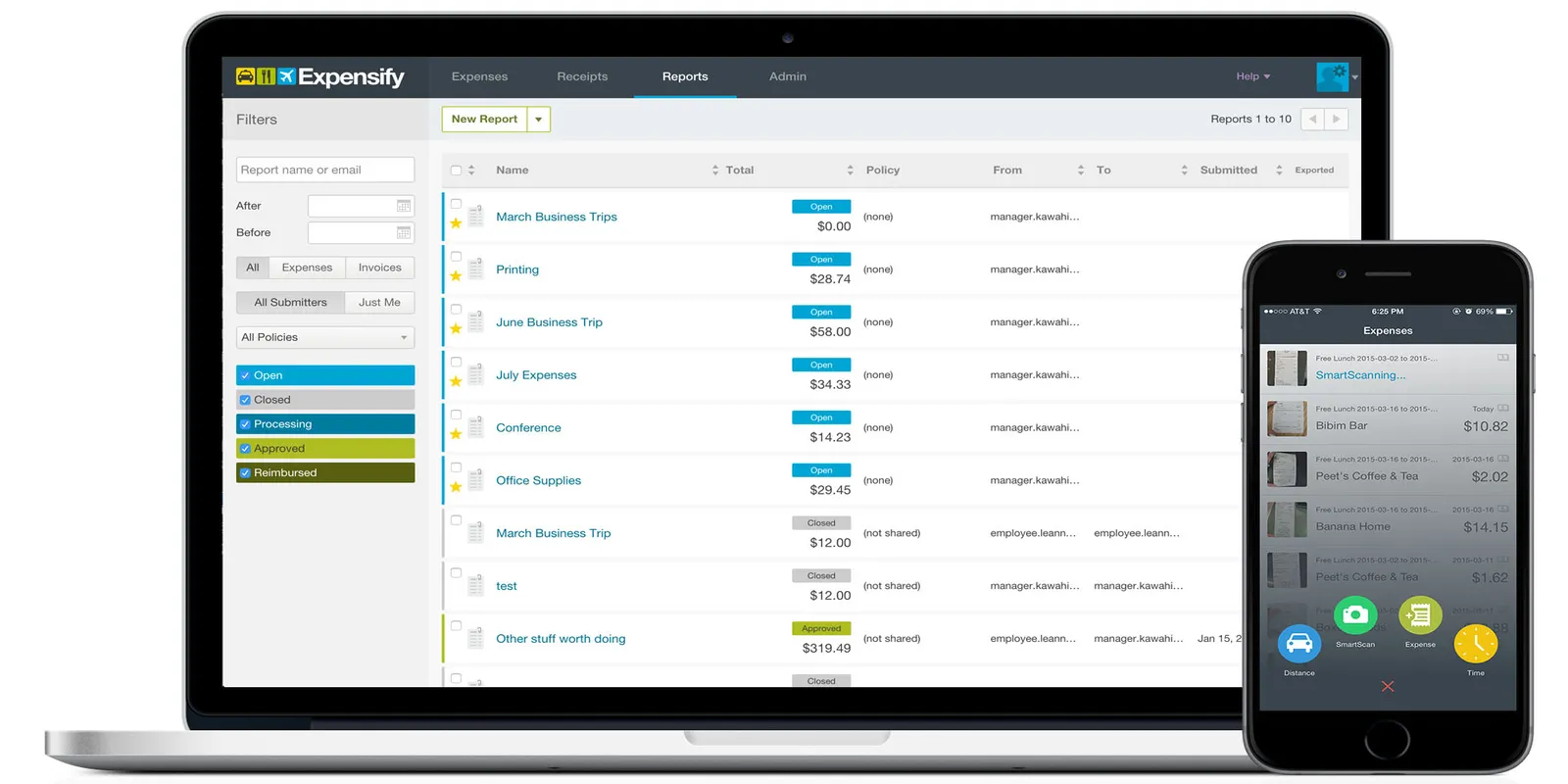

1. Expensify

Expensify is one of the most recognized travel expense software solutions. Designed for both small teams and large enterprises, Expensify offers a user-friendly mobile app, smart scan features, and automatic report generation.

Its real-time expense tracking and customizable policy rules make it ideal for companies with frequent business travelers. The software also integrates with accounting tools like NetSuite, QuickBooks, and Xero, making it a comprehensive solution for financial management.

Expensify’s strength lies in its SmartScan technology, which extracts all relevant details from receipts, including the amount, merchant, and date, greatly reducing manual entry time.

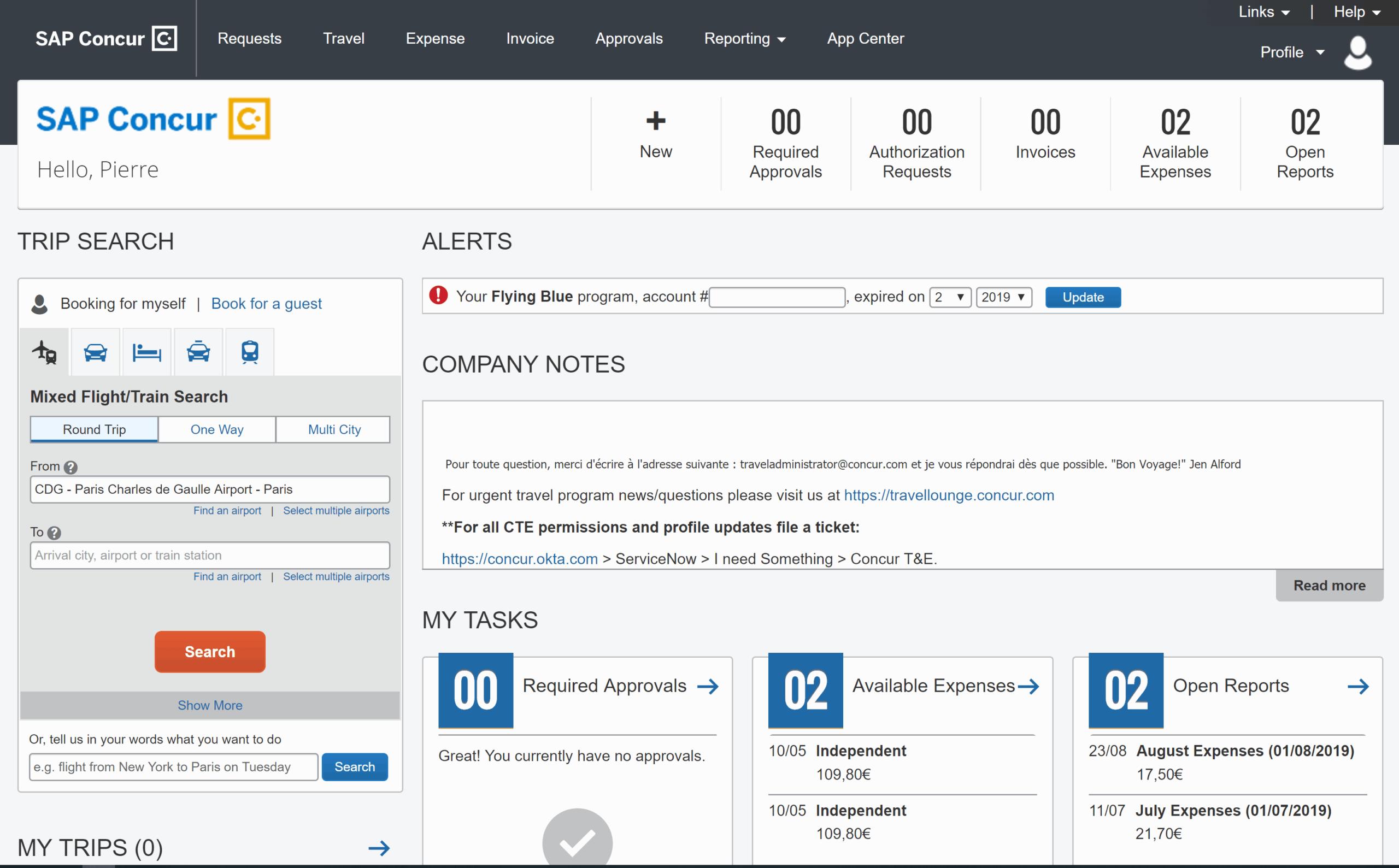

2. SAP Concur

SAP Concur is an enterprise-grade travel and expense management platform used by many Fortune 500 companies. It offers advanced automation features, robust compliance monitoring, and in-depth analytics capabilities.

SAP Concur stands out due to its ability to integrate corporate travel bookings directly into the expense workflow. This enables organizations to capture spending at the source and automatically generate expense reports with minimal effort from employees.

Additionally, it provides detailed audit trails, making it easier for finance teams to track every transaction and ensure internal compliance.

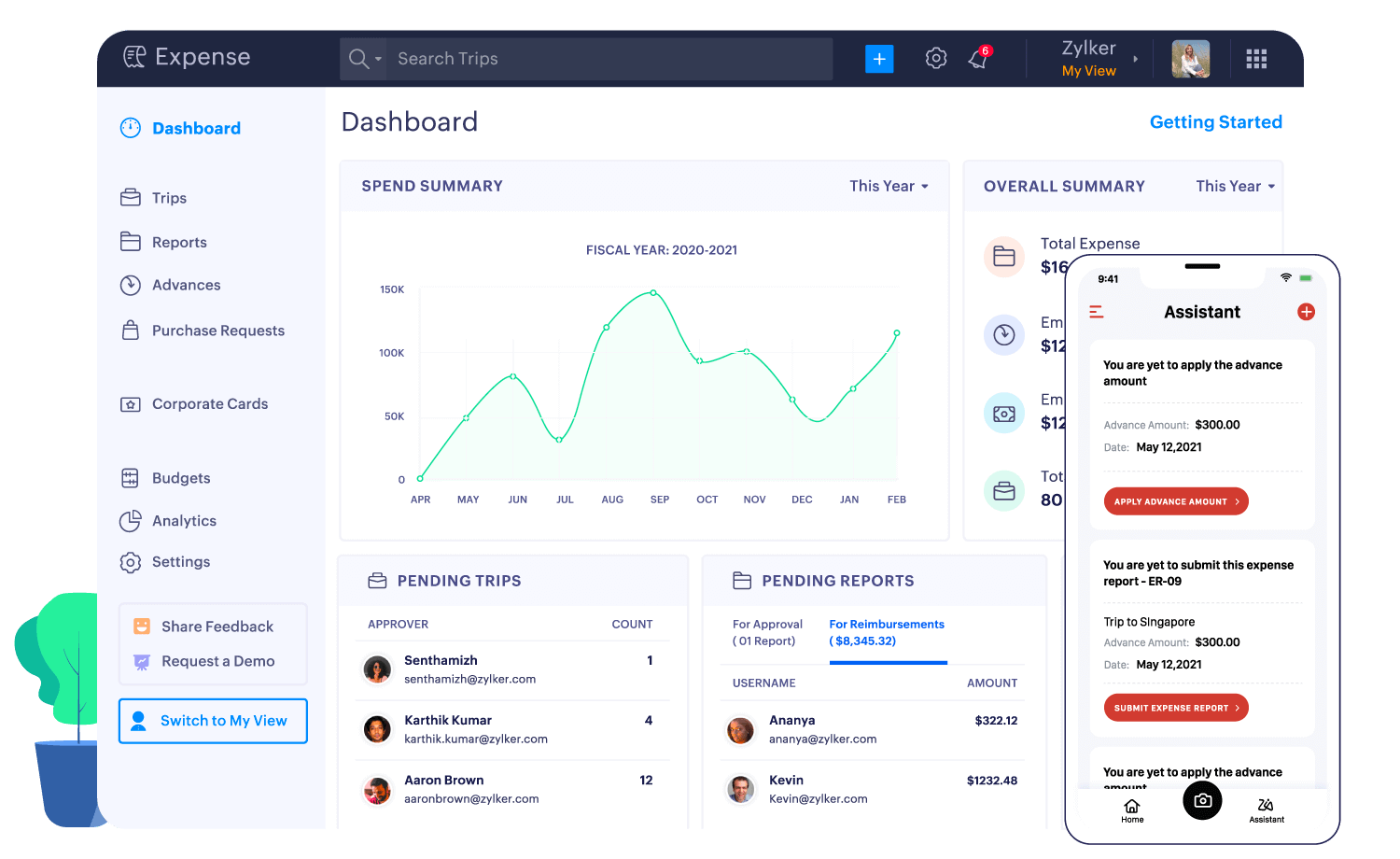

3. Zoho Expense

Zoho Expense is an affordable and efficient solution tailored for small and mid-sized businesses. With its intuitive interface and mobile capabilities, it allows employees to report expenses while on the go and ensures managers can approve them from anywhere.

Zoho Expense supports multi-currency and multi-country operations, which is essential for international businesses. Features like mileage tracking, direct card feeds, and automatic categorization make it one of the most versatile solutions in its segment.

Another benefit is Zoho Expense’s ability to enforce approval hierarchies and automate per diem calculations, reducing administrative overhead.

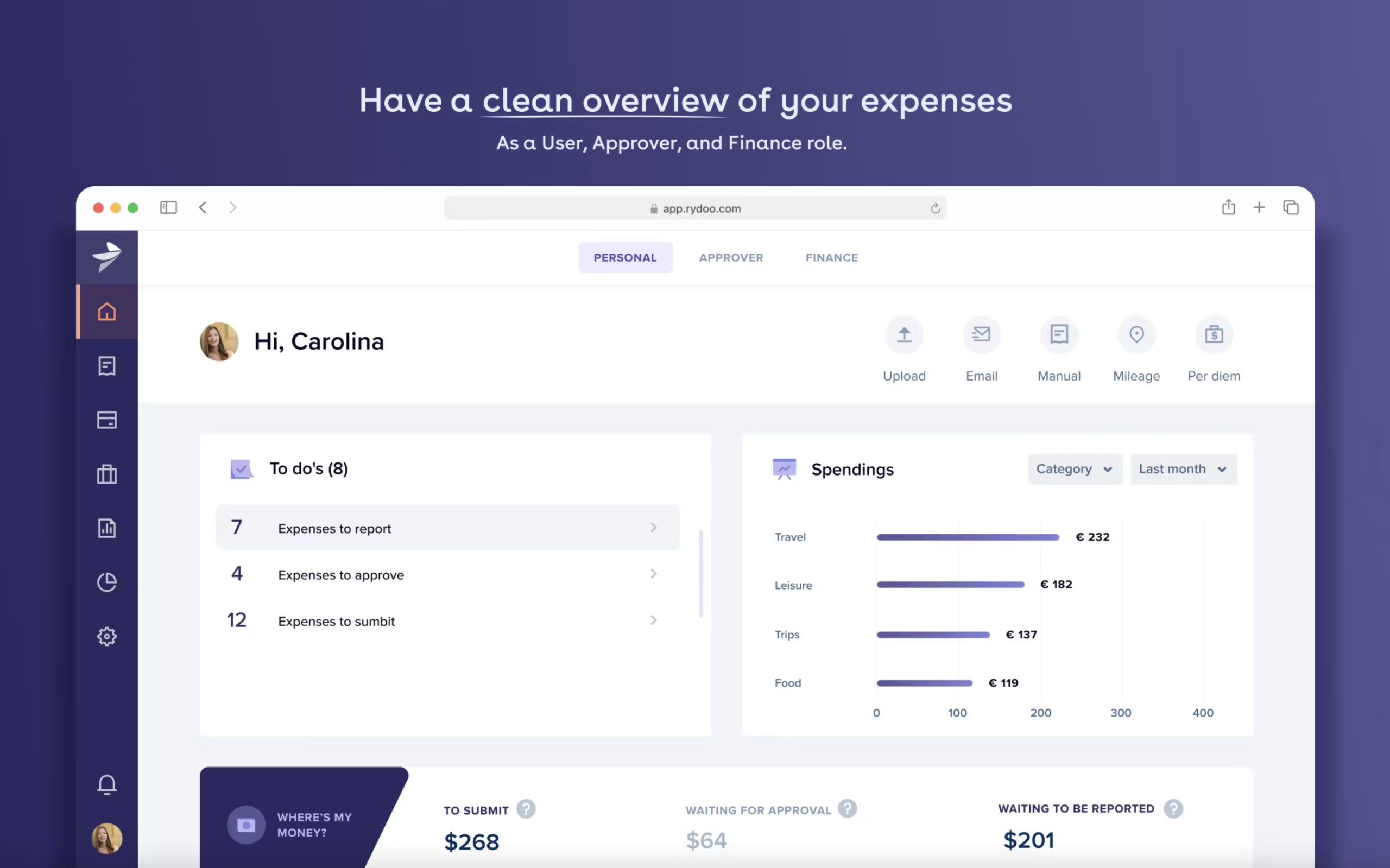

4. Rydoo

Rydoo is a modern travel expense platform focused on usability and real-time functionality. It’s best suited for teams that value speed and efficiency. Employees can log expenses within seconds using their smartphones, while managers receive instant notifications for approval.

Rydoo also features real-time policy enforcement, ensuring every submission meets the company’s travel policy. Integration with popular HR and accounting systems adds to its appeal, making it a solid choice for fast-growing companies with remote or hybrid teams.

Rydoo’s dashboard provides deep insight into trends, helping finance departments make data-driven decisions.

5. Certify by Emburse

Certify is designed for companies looking for a comprehensive suite of travel, expense, and invoice automation. It automates nearly every aspect of the expense lifecycle — from capturing receipts to auditing and analytics.

Certify also includes a travel booking engine, allowing employees to book flights and accommodations that comply with company policies. Its AI-powered audit system flags unusual entries for human review, ensuring security and compliance.

Certify’s offline mode is particularly useful for travelers who may not always have internet access, enabling them to continue logging expenses on the go.

Real-Life Use Cases and Solutions

Managing Travel for Remote Teams

As more businesses adopt remote-first or hybrid work models, managing travel expenses for distributed teams becomes critical. Travel expense software helps standardize how expenses are reported, regardless of location, ensuring fairness and transparency across all teams.

Scaling Operations Across Regions

Businesses operating in multiple countries often face challenges with currency conversions, tax compliance, and policy enforcement. With travel expense software that supports multi-currency and tax regulations, companies can ensure seamless operations across global offices.

Reducing Fraud and Expense Abuse

Travel-related fraud, such as duplicate claims or inflated mileage, can cost businesses thousands annually. Travel expense software uses audit algorithms and policy checks to detect anomalies early, protecting the organization from financial loss.

Streamlining Expense Reporting for Frequent Travelers

Sales representatives, consultants, and executives often travel for business and struggle to keep track of physical receipts. With mobile-friendly travel expense apps, they can submit claims immediately, improving compliance and reducing backlog.

Enhancing Financial Forecasting and Budgeting

By centralizing travel expense data, businesses gain valuable insights into spending trends. This allows CFOs and finance teams to forecast budgets more accurately and adjust travel policies based on historical data.

Benefits of Using Technology for Travel Expense Management

Automation Eliminates Manual Errors

Digital expense tools eliminate the need for spreadsheets and manual reconciliation. Automation ensures entries are accurate, timely, and categorized correctly based on policies.

Enhanced Productivity and Employee Satisfaction

Employees appreciate tools that simplify their tasks. With travel expense software, they can focus more on work rather than admin tasks. This leads to better job satisfaction and improved productivity across departments.

Real-Time Monitoring and Decision-Making

Executives can monitor spend in real-time and make quick decisions if costs exceed budgets. Dashboards and reports help highlight outliers and provide actionable insights.

Custom Policies and Flexible Approval Chains

Modern platforms allow companies to create custom travel policies and dynamic approval workflows. This means every expense claim follows a clear path, reducing confusion and delays.

Frequently Asked Questions

Q1. What is the best travel expense software for small businesses?

Zoho Expense and Expensify are top choices for small businesses due to their affordability, ease of use, and robust mobile features. They help streamline expense tracking and reporting without needing a large IT infrastructure.

Q2. Is travel expense software secure for financial data?

Yes, most reputable travel expense tools use encryption, multi-factor authentication, and secure cloud infrastructure to protect sensitive financial information. Always choose software with SOC 2 or ISO certifications for added peace of mind.

Q3. Can travel expense software integrate with our accounting system?

Absolutely. Most leading platforms like SAP Concur, Expensify, and Rydoo integrate with popular accounting tools such as QuickBooks, Xero, and Oracle. This ensures a seamless transfer of approved expenses to your accounting records.